Beer market trends in CHR 2024

The beer market in France's CHR (Cafés, Hôtels, Restaurants) is proving resilient despite the economic difficulties, as shown by Flash 2024 survey by the French National Beverage Federation (FNB). For professionals in the sector (brewers, distributors, on-trade and off-trade), it is essential to understand current trends in this market in order to adapt their strategies.

In this article, we'll explore the results of FNB's flash survey and analyze the key trends. We'll be looking at consumption, popular beer categories, preferred formats and the outlook for 2025. We're off! 🍻

A precarious balance: stability and growth in the on-trade

Volume and sales trends

The FNB survey reveals a mixed picture. While the volume of beer sales in the on-trade remained stable for 57% of the professionals questioned, it was down for 35% of them. Conversely, sales rose for 43% of respondents, while they fell for 35%.

How can we explain this difference between volume and sales? 🤔 Several factors come into play. Firstly, the impact of the economic situation is not uniform. Some establishments, particularly those located in tourist areas or offering premium products, are weathering the crisis better. Secondly, the rise in beverage prices, linked to inflation, is helping to boost sales, even if sales volumes remain stable or even fall slightly.

Impact of inflation and purchasing power

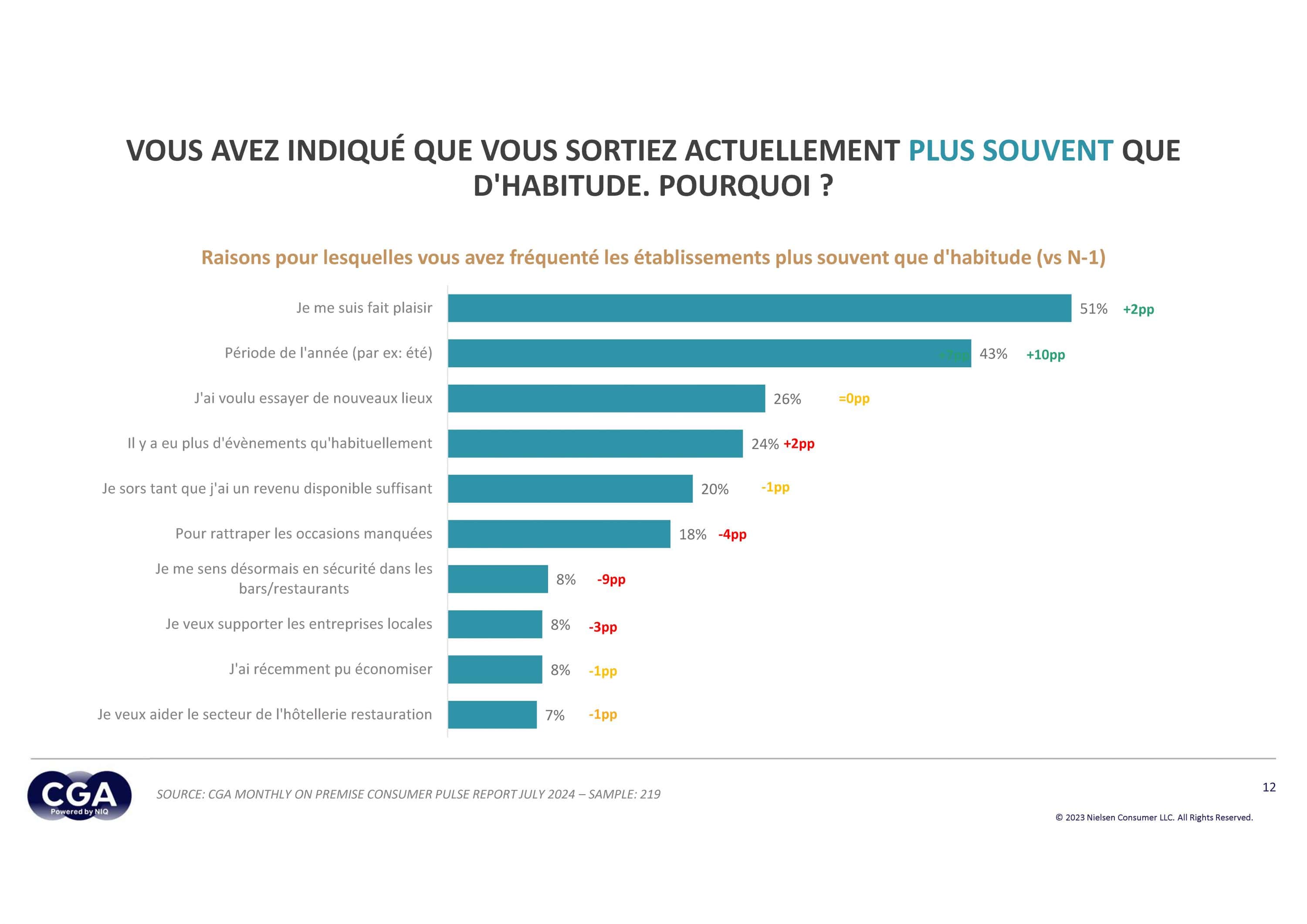

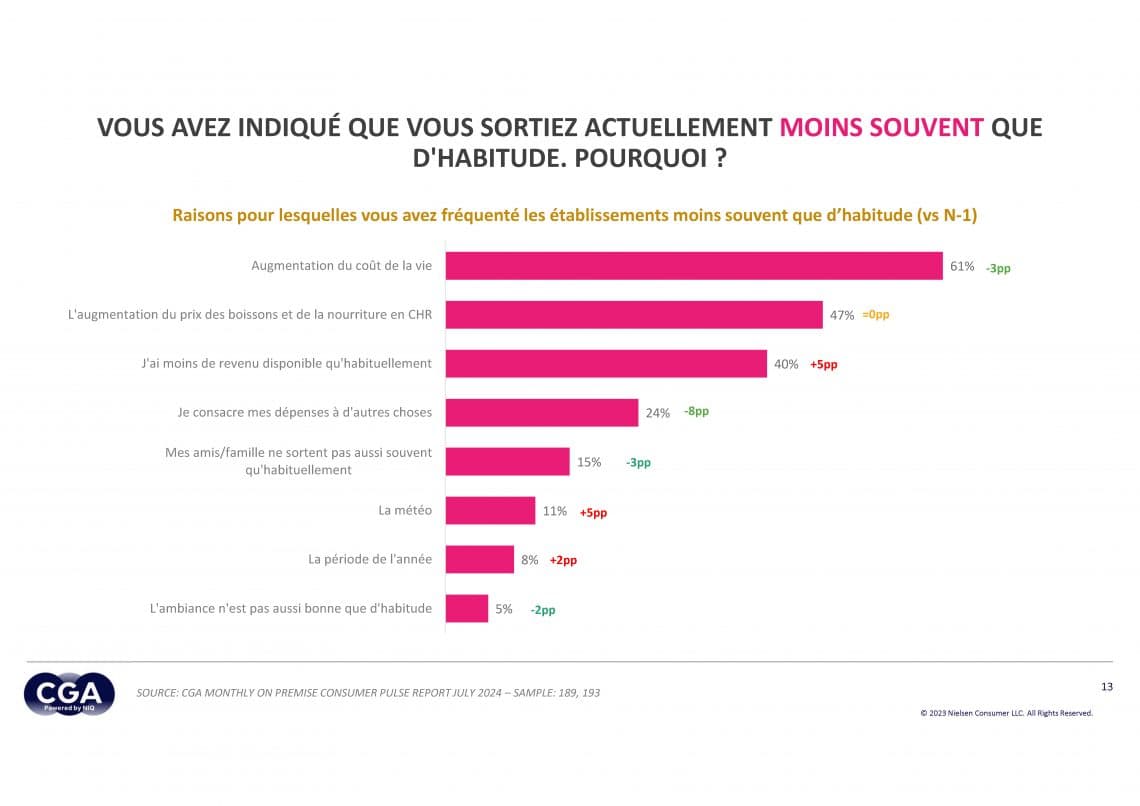

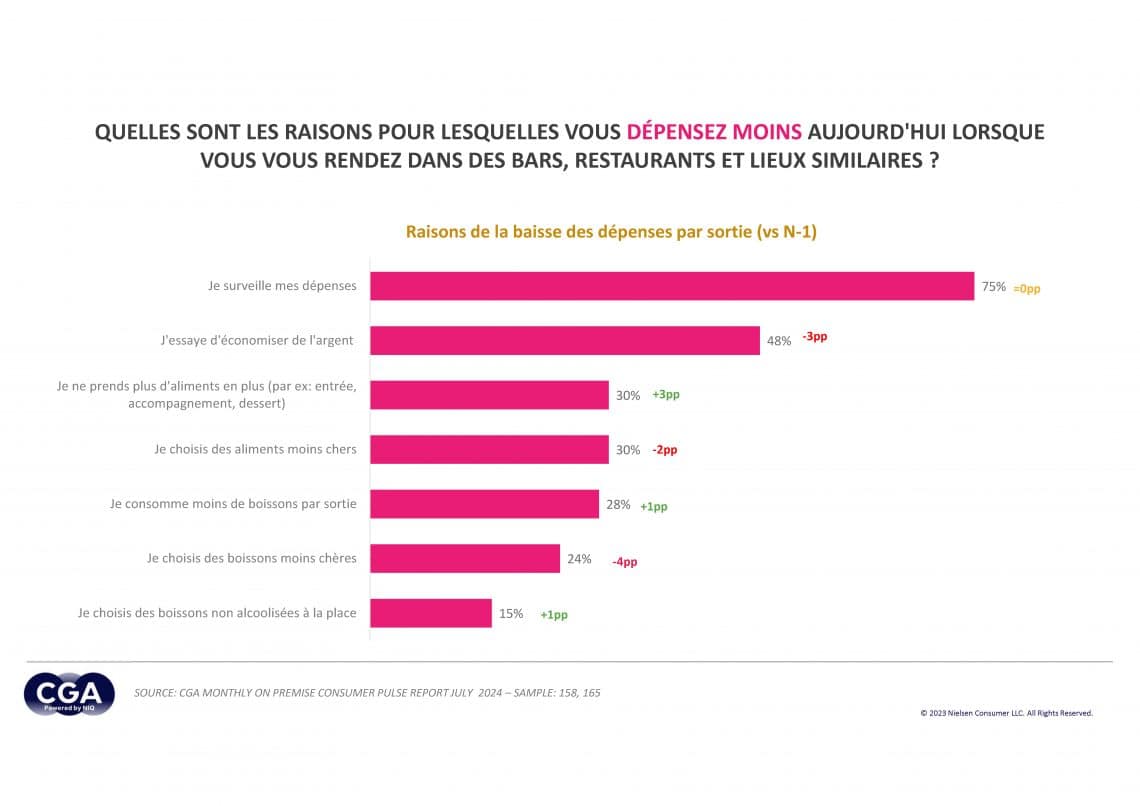

Inflation has a direct impact on consumption habits in the on-trade. Nielsen IQ data show a reduction in spending in cafés, hotels and restaurants, as consumers become more budget-conscious. This is reflected in a drop in the number of drinks consumed per outing.

Faced with rising prices, consumers are adopting various strategies to save money. Some are turning to cheaper drinks, such as entry-level beers. Others opt for non-alcoholic beverages, such as soft drinks or fruit juices. There is also a trend towards happy hours and promotional offers.

Flagship beers for the on-trade: Non-alcoholic beers and IPAs on the rise

Dominance of the classics and emergence of new segments

Classic beers, such as luxury lagers, amber/reds and special beers, continue to play an important role in the on-trade. However, new segments, such as non-alcoholic beers and IPAs (India Pale Ale), are making strong headway.

Alcohol-free beers are winning over more and more consumers. According to the FNB survey, 74% of the professionals questioned noted an increase in demand for this type of beer. IPAs are also enjoying growing success, with 83% of respondents noting an increase in their popularity.

Analysis of demand and growth factors

There are a number of reasons why non-alcoholic beers and IPAs are so popular. Firstly, drinking habits are changing. Consumers are increasingly health-conscious, and are looking for lower-calorie, lower-alcohol beverages. They are also looking for new flavors and original taste experiences.

Diversification of the alcohol-free beer offer also plays an important role. Craft breweries offer quality non-alcoholic beers in a variety of original flavors.

The success of IPAs, meanwhile, is linked to the diversity of styles and flavors on offer. From classic IPAs to fruity NEIPAs and hoppy Black IPAs, there's something for everyone!

Formats and packaging: reusability in the lead

Returnable bottles and kegs: the norm in the hospitality sector

In terms of formats and packaging, reusable bottles and kegs are becoming increasingly popular in the on-trade. For non-alcoholic beers, single-use 33cl bottles are still in the majority. On the other hand, for other beer categories, notably IPAs and abbey beers, reusable formats (bottles and kegs) are the norm.

The special case of non-alcoholic beer kegs

The supply of reusable 20L kegs for non-alcoholic beer remains stable, with 70% of respondents offering this format. However, the development of this format is hampered by several factors. Firstly, there is uncertainty about the actual demand for non-alcoholic beer kegs. Secondly, keeping the product in kegs can pose problems, particularly in terms of shelf life and quality.

Outlook for 2025: towards a more varied beer offering

Entry-level vs. premium beers

The beer market in the on-trade seems to be moving towards a polarization of supply. On the one hand, entry-level beers, often sold «naked», are struggling to make a name for themselves. On the other, craft beers, IPAs and specialty beers continue to grow in popularity. Should we create low-cost beer? That's a question Ludovic and Dorothée ask themselves in an episode of their podcast 1000 Hectos.

Craft breweries on the rise

Craft breweries are playing an increasingly important role in the on-trade beer market. According to the FNB survey, the market share of craft beers in the on-trade is between 5 and 15% for 80% of respondents.

Craft breweries benefit from a number of advantages. They can promote their local know-how and offer authentic, original beers. They can also adapt more easily to new trends and specific consumer demands. And let's not forget the higher taxes on alcohol impacting the market!

In the end

The beer market in the on-trade is undergoing a major transformation. It is marked by relative stability, the rise of alcohol-free beers and IPAs, and the growing importance of reusables.

To remain competitive, industry professionals need to adapt to these new trends. In particular, they need to focus on the quality of their products, the diversification of their offer and collaboration with distributors. The future of the on-trade beer market looks promising for those players who know how to innovate and meet the ever-changing expectations of consumers.

FAQ

The main reason is the rising cost of living (61% of respondents). Consumers are watching their spending more closely, and reducing their consumption of drinks per outing. Some are now giving priority to other forms of leisure or pleasure purchases.

Non-alcoholic beers are experiencing significant growth, with 74% of respondents reporting increased sales. Nonetheless, this segment remains a niche market, but one that is growing strongly, driven by changing consumption patterns and an expanding product offering.

The establishments are developing a balanced range strategy between classic entry-level beers and premium references. They are integrating more craft beers and IPAs to meet new expectations. Promoting local products is also becoming an important selling point.

The market is showing encouraging stability, with 57% of respondents noting stable volumes. Sales are up for 43% of players, suggesting a premiumization of the market. Craft beers and IPAs continue to grow, accounting for up to 15% of the offer in some establishments.

The market should continue to polarize between entry-level products and premium offerings. Craft and speciality beers should continue to develop, while classic beers will maintain their position. Particular attention will be paid to price management in the face of consumers' economic constraints.

Did you enjoy this episode of 1000 Hectos ? Give it a try...

- 5 steps to maximize the impact of beer competitions

- How to judge a beer at a competition: behind the scenes and the truth about medals

- Beer market trends in CHR 2024

- Brewing news: between fiscal challenges, alcohol-free and sustainable innovations

- The secrets of mascots to boost your brand identity

- New European regulations raise questions about pesticides in hops