Olive Oil and Condiment Trends in 2025

The global food and beverage industry is dynamic and ever-evolving, with consumer preferences and market trends constantly shaping the landscape. In this comprehensive report, we delve into the olive oil and condiment markets, exploring key trends anticipated for 2025.

This report will provide valuable insights into market forecasts, consumer behaviors, and packaging innovations, with a particular emphasis on the crucial role of packaging design in influencing purchasing decisions.

Olive Oil Market Outlook

A cultural shift towards healthier diets has significantly contributed to the growth of the olive oil market in recent years, with consumers increasingly recognizing its nutritional value and incorporating it into their culinary practices. Effective marketing and promotional campaigns have also played a crucial role in raising awareness about the benefits of olive oil and driving market growth by highlighting its versatility and culinary applications.

The global extra virgin olive oil market is expected to reach USD 19.8 billion by 2031, with a compound annual growth rate (CAGR) of 4.5%. This growth is fueled by increasing consumer awareness of the health benefits associated with olive oil, particularly extra virgin olive oil, which is rich in antioxidants and monounsaturated fats. The rising popularity of the Mediterranean diet, which emphasizes olive oil as a key component, further contributes to this trend.

In 2024, global olive oil production is estimated to be 2,564,000 tons, reflecting a slight decrease from the previous year. Consumers demonstrate a clear preference for EVOOs with specific credence attributes, such as a clear origin or an organic label, indicating the importance of transparency and quality assurance in purchasing decisions.

The global extra virgin olive oil market is expected to reach USD 19.8 billion by 2031

Olive Oil Key Market Trends

Health and Wellness: Consumers are increasingly prioritizing health and wellness, seeking out natural and organic food products. Olive oil aligns with this trend, as it is perceived as a healthy and natural fat source.

Premiumisation: The demand for premium and specialty olive oils is on the rise 1. Consumers are willing to pay a premium for high-quality olive oils with specific flavor profiles, origins, and certifications.

Sustainability: Environmental concerns are influencing consumer choices, with a growing preference for sustainably sourced and packaged olive oils.

Globalisation: The olive oil market is becoming increasingly globalized, with consumers exploring olive oils from different regions and countries.

Production Factors: It's important to note that olive oil production can be influenced by various factors, including climate change and environmental conditions, which can impact yield and potentially affect market stability.

Market Size and Growth

| Market Segment | Region | CAGR | Forecast Period |

| Extra Virgin Olive Oil | Global | 4.5% | 2024-2031 |

| Olive Oil | North America | 7.3% | 2023-2030 |

| Virgin Olive Oil | U.S. | 8.3% | 2025-2030 |

| Canned Olive Oil | U.S. | 6.2% | 2025-2030 |

| Asia-Pacific Condiments Market | Asia-Pacific | 5.8% | 2018-2025 |

| Sauces, Condiments, and Dressings Market | Global | 5.74% | 2024-2029 |

Condiment Market Outlook

The condiment market is also experiencing significant growth, driven by evolving consumer tastes and preferences. The global condiments market is expected to continue its growth in 2025 due to rising disposable incomes, expanding urbanization, and the changing culinary landscape.

Consumers are expected to continue to favor organic, vegan, and vegetarian options, which will lead to the production of more condiments made with Sorbic acid, glass jars, and PET bottles. In the U.S., the condiments market currently stands at $12 billion, with salad dressings valued at $4 billion. It's important to recognize that condiment preferences can vary significantly based on region and age demographics.

For example, Gen Z consumers tend to be more adventurous in their flavor choices, while older generations often stick with familiar favorites.

Condiment Key Market Trends

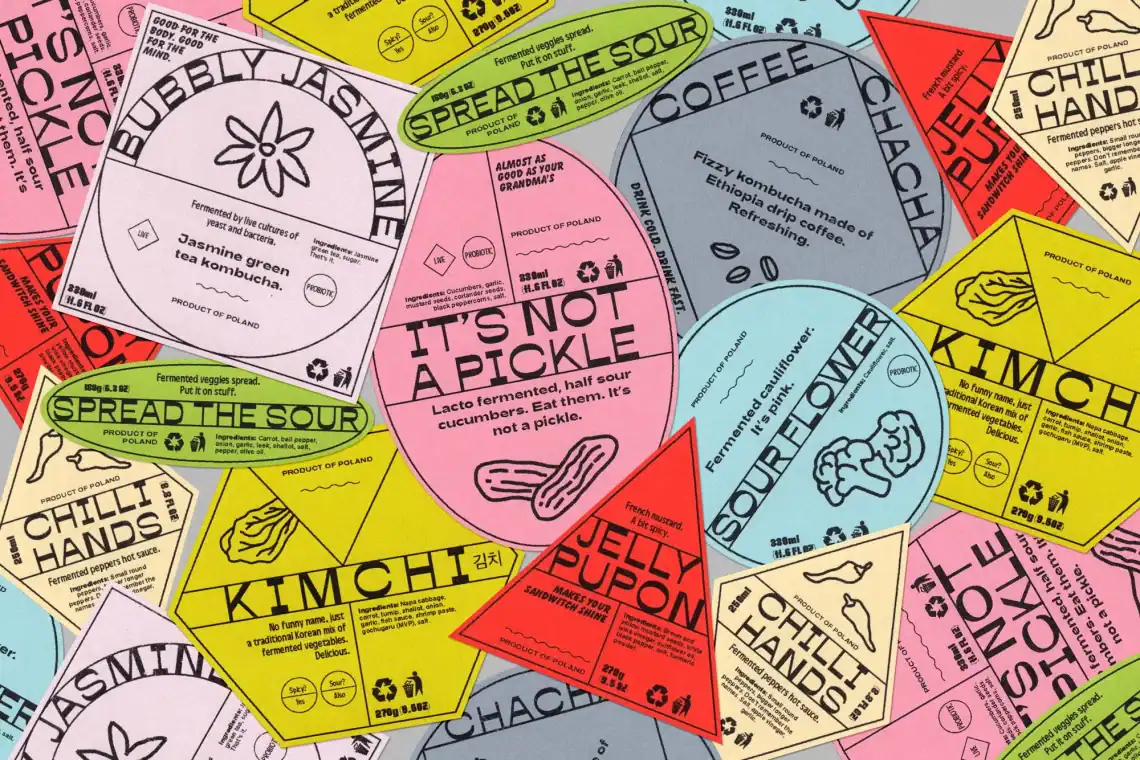

Flavor Innovation: Consumers are seeking out new and exciting flavors, leading to innovation in the condiment industry. This includes the development of unique flavor combinations, ethnic flavors, and exotic ingredients.

Plant-Based Options: The demand for plant-based and vegan condiments is increasing, driven by the growing popularity of vegan and vegetarian diets.

Healthier Choices: Consumers are becoming more health-conscious, seeking out condiments with lower sugar, sodium, and fat content.

Convenience: Busy lifestyles are driving demand for convenient condiment packaging, such as squeeze bottles, single-serve packets, and pouches.

The Impact of Packaging Design

Packaging design plays a crucial role in consumer purchasing decisions, particularly in the food and beverage industry. For olive oil and condiments, packaging serves several essential functions:

- Preservation: Protecting the product from light, air, and moisture, which can degrade quality and flavor. For example, dark green glass bottles help to prevent olive oil from spoiling due to light exposure. Airtight lids on jars help to keep condiments fresh.

- Information: Communicating essential information to consumers, such as ingredients, nutritional content, and origin. Olive oil labels often include the harvest date and origin of the olives. Condiment labels clearly display the ingredients and nutritional information.

- Branding: Creating a brand identity and differentiating the product from competitors. Unique bottle shapes and label designs help brands stand out.

- Convenience: Providing ease of use and portion control. Squeeze bottles and single-serve packets offer convenience.

Sustainability in Packaging

Consumers are increasingly concerned about the environmental impact of packaging. This has led to a rise in sustainable packaging options for olive oil and condiments, such as:

- Bag-in-box containers: These have been found to have a 60% to 90% lower environmental impact compared to single-use glass bottles.

- Aluminum cans: These are lightweight and recyclable.

- Recyclable plastic bottles: These are becoming more common as recycling infrastructure improves.

- Compostable bioplastics: These are made from plant-based materials and can be composted at home or in industrial facilities.

- Recyclable and compostable materials: The condiment industry is increasingly focused on reducing environmental pollution through packaging innovation. This includes adopting sustainable materials, optimizing production processes for energy efficiency, and minimizing waste throughout the supply chain.

Olive Oil Packaging Trends

Material Innovation: New materials are being used for olive oil packaging, such as seaweed pipettes and compostable bioplastics. These materials offer improved sustainability and functionality.

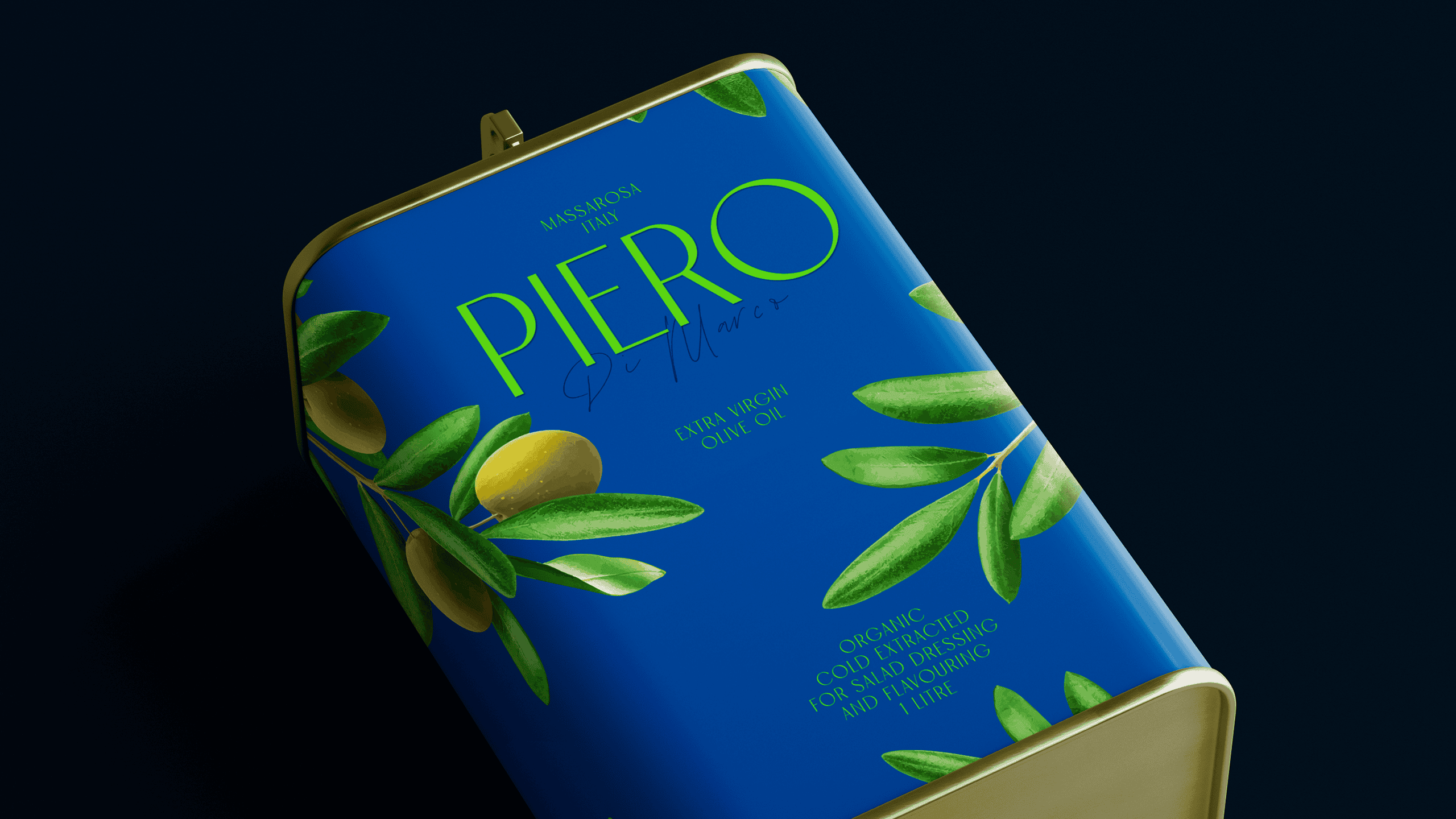

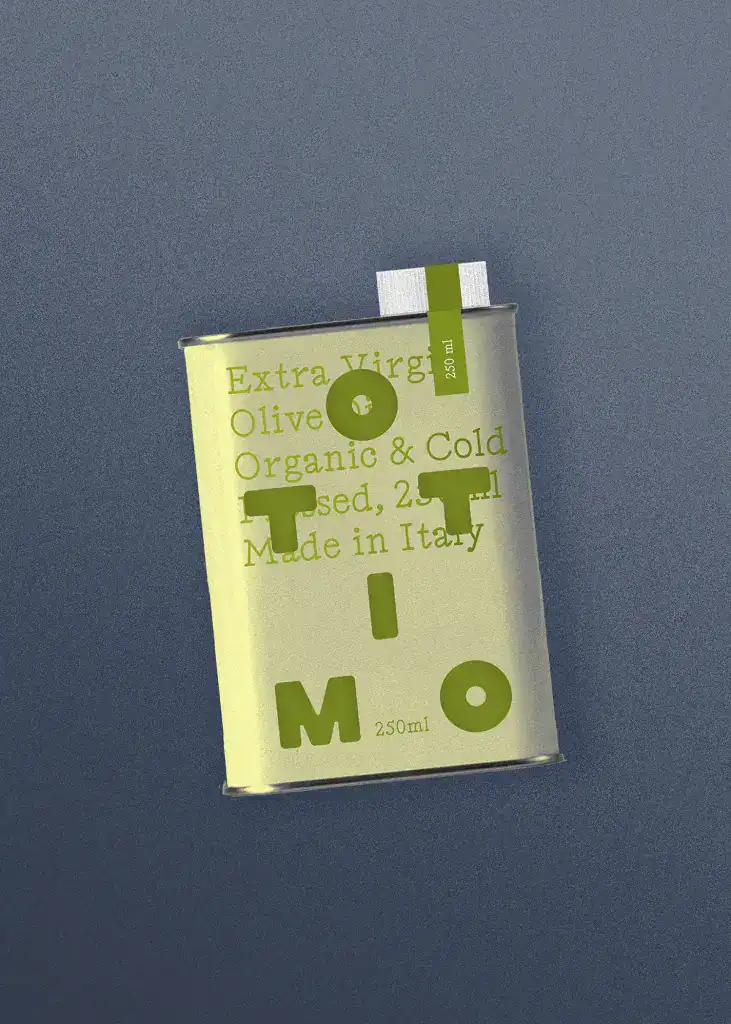

Design Aesthetics: Olive oil packaging is becoming more design-focused, with brands using unique shapes, colors, and labeling to attract consumers.

Functionality: Packaging that provides convenience and ease of use is becoming increasingly important. This includes features such as pour spouts, drip-free caps, and squeeze bottles.

Consumer preference for smaller olive oil packaging: Research indicates a consumer preference for smaller olive oil packaging sizes, likely due to factors such as perceived value for money and ease of use.

Consumer understanding of olive oil grades: Interestingly, while many consumers believe they understand the different grades of olive oil, research suggests a significant portion remains unsure about the specific meanings and quality distinctions between these grades.

Consumer knowledge and attitudes towards olive oil usage: Consumer knowledge and attitudes regarding olive oil usage and storage practices are crucial factors to consider in packaging design. Packaging should aim to educate consumers and provide clear instructions on proper storage to maintain olive oil quality and maximize shelf life.

Consumer preference for bulk olive oil: While smaller packaging sizes are generally preferred, there is also a segment of consumers who opt for bulk olive oil purchases, often in tin packaging, suggesting a need for packaging options that cater to different consumption patterns and needs.

Impact of Packaging on Purchase Decisions: When buying olive oil, consumers first notice the packaging design, followed by the label. An eye-catching design can attract customers and give them a perception of higher quality. However, the importance of packaging should not prioritize elegance over the preservation of the olive oil's organoleptic qualities. The material, color variety, design, and clear and distributed information are the visual characteristics that most influence the purchase intention of olive oils. Consumers do not know the correct definition of extra virgin olive oil and acidity index, thus it is necessary to improve the interactions between consumers and products to provide a better understanding of food labels. While sustainable materials like tinplate and coated paperboard offer excellent protection from light and oxygen, they often lack transparency, which can be a barrier for consumers who rely on visual cues to assess olive oil quality. Balancing sustainability with consumer preferences for seeing the oil's color remains a key challenge for packaging design.

Condiment Packaging Trends

Convenience: Consumers are seeking out convenient packaging options for condiments, such as squeeze bottles, pouches, and single-serve packets.

Portion Control: Packaging that allows for portion control is becoming increasingly important, as consumers seek to reduce food waste.

Durability: Condiment packaging needs to be durable to withstand handling and transportation.

Impact of consumer demographics on condiment packaging: Shifting consumer demographics, such as the rise of single-person households, are influencing condiment packaging trends, with increasing demand for smaller pack sizes that cater to individual consumption patterns and reduce food waste.

Consumer expectations for condiment brands: Beyond basic functionality, consumers now expect more from condiment brands, including a commitment to sustainable packaging practices, creative application ideas to inspire usage, and a wider range of flavor profiles and nutritional options.

Role of color and shape in condiment packaging: Color and shape play a significant role in condiment packaging, influencing consumer perception of quality and brand recognition. Iconic shapes and distinctive colors can help products stand out on shelves and create a lasting impression on consumers.

Impact of Packaging on Purchase Decisions: Research shows that 72% of American consumers say that packaging design influences their purchase decision. Appealing packaging can attract consumers' attention, evoke emotions, and reflect quality, which can encourage purchases.

Poor packaging design can lead to product damage or miscommunication, ultimately deterring customers and resulting in lost sales. Consumers expect packaging that's intuitive and easy to open, squeeze, and reseal. Packaging design also plays a crucial role in brand differentiation and appeal. Consumers are drawn to packaging that is visually appealing and aligns with their values, such as sustainability. Packaging design can affect consumer behavior and drive sales by creating a sense of perceived value, differentiating a product from competitors, and evoking an emotional response.

The demand for single-serve condiment packets is steadily increasing, driven by consumer desire for convenience and portability. These packets also address concerns about portion control and waste reduction, making them an attractive option for both consumers and environmentally conscious brands. Designing condiment packaging requires a careful balance between functionality and aesthetics. While consumers expect convenient and easy-to-use packaging, they are also influenced by visual appeal and brand identity. Achieving this balance, especially while considering cost constraints, remains a key challenge for packaging designers.

Examples of Innovative Olive Oil and Condiment Packaging

Neolea This olive oil brand has introduced eco-friendly aluminum cans with reusable caps, enhancing the customer experience and addressing environmental concerns. The reusable cap is dishwasher safe and helps to maintain the olive oil's freshness.

GOZO : This brand uses ceramic packaging for its olive oil, combining utility and aesthetic appeal to elevate the cooking experience. The minimal design and embossed branding turn the packaging into a display piece.

Heinz : In collaboration with Berry Global, Heinz has developed the first 100% recyclable ketchup cap, addressing the challenge of recycling caps with flexible silicone valves.

Kari-Out : This foodservice packaging company has introduced the industry's first 100% compostable condiment packet, made from plant-based materials. All packets can be printed with logos and other product information.

Conclusion

The olive oil and condiment markets are dynamic and evolving, with consumer trends and packaging innovations shaping the future of these industries. Health and wellness, premiumization, sustainability, and convenience are key factors driving market growth and influencing consumer choices. Packaging design plays a crucial role in communicating product quality, enhancing brand identity, and providing convenience to consumers.

As we look ahead to 2025, we can expect to see continued innovation in both olive oil and condiment packaging, with a focus on sustainability, functionality, and aesthetics. To stay competitive, brands must stay informed about consumer preferences and adapt to the evolving market landscape.

FAQ on Olive Oil And Condiment Trends For 2025