Non-Alcoholic Beverage Trends 2025: Luxury, Health and Innovation

The essentials in 30 seconds

Market size : The non-alcoholic beverage industry is expected to grow from 1.1 trillion $ (2018) to 3.8 trillion $ by 2034. The US market will reach 225.62 billion $ in 2030. Annual growth (CAGR): 4.7 % to 7.75 %.

The 5 key trends in 2025 :

- Functional ingredients - Adaptogens (ashwagandha, reishi, maca), nootropics, superfoods: drinks now deliver health benefits (energy, relaxation, concentration)

- Sophisticated flavors - Tannins, spices, multiple infusions: premium mocktails rival classic cocktails in aromatic complexity.

- Advanced dealcoholization technology - GoLo System, Alfa Laval, IA: achieve 0.0 % alcohol without sacrificing taste or texture

- Sober Curious« movement» - From Dry January to daily rituals: alcohol-free drinking becomes normalized on every occasion (morning detox → afternoon low sugar → evening mocktails).

- Eco-responsible & tech packaging - Recycled materials (PCR glass, aluminum), nomadic formats + AR experiences (e.g. Lyre's Impossible Bar)

Brands to watch:

Pioneers: Curious Elixirs - Seedlip - Lyre's - ISH Spirits - Little Saints - Aplós

Major groups : Diageo (Guinness 0.0) - Pernod Ricard (Ceders) - Heineken 0.0 - Carlsberg

To remember: Non-alcoholic beverages are no longer confined to Dry January - they have become an integral part of every moment of life, from the moment we wake up in the morning to the evening, driven by a generation in search of well-being and responsible conviviality.

What about beverage trends in 2026?

The beverage industry is undergoing a major transformation in 2026, driven by three converging forces: the quest for health benefits, the spectacular rise of the alcohol-free segment and the arrival of giants in emerging niches. The functional beverage market is expected to reach $160-180 billion, while US prebiotic sodas have exploded by 301% in 2023. PepsiCo's acquisition of Poppi for nearly $2 billion and Coca-Cola's launch of Simply Pop confirm that gut health is no longer a niche trend, but the new mainstream.

Beyond gut health, several beverage trends are redefining the landscape In the US, nootropics such as lion's mane and ashwagandha are gradually replacing raw caffeine to provide a «calm focus», premium alcohol-free beer is growing by 22% with Athletic Brewing holding 52% of the US NA craft market, and enhanced hydration is transforming plain water into a functional product enriched with electrolytes and vitamins. On the regulatory front, pressure on sugars is intensifying with the extension of taxes in the UK and the new FDA definition of «Healthy», pushing the industry towards massive reformulation. A profound generational shift accompanies these developments: 45 to 50% of Gen Z over-21s have never consumed alcohol, making sophisticated alcohol-free a lifestyle choice rather than a deprivation.

Introduction

Non-alcoholic beverages are experiencing unprecedented growth, driven by various factors: prioritizing wellness, the rise of the "sober curious" movement, demand for more sophisticated flavors, and the search for healthy solutions to maintain social connections.

According to several analyses, including a study indicating a global market valued at 1.1 trillion dollars in 2018, the non-alcoholic beverage industry is expected to reach 3.8 trillion dollars by 2034. Additionally, the U.S. market could climb to 225.62 billion dollars by 2030.

In this article, we explore the strong trends forming the foundation of an increasingly creative and diverse offering. We'll examine particularly the emergence of functional ingredients (superfoods, adaptogens, nootropics), flavor complexity, the mainstreaming of alcohol-free rituals, eco-conscious packaging choices, and the contribution of technology (AI, AR) in this new landscape.

1. Evolution of the Non-Alcoholic Beverage Market

1.1 Steady Growth and New Consumer Profiles

From 2019 to 2025, projections show a compound annual growth rate (CAGR) ranging from 4.7% to 7.75%. In addition to the priority given to health and well-being, the “sober curious” phenomenon is reinforcing demand. Millennials and Gen Z are increasingly embracing these alcohol-free alternatives, backed by heightened social and environmental awareness:

- Health and Well-Being: Pursuit of “cleaner” products, free from unwanted effects.

- Innovation: Complex-tasting products developed through precise technological processes (alcohol-free distillation, vacuum evaporation, etc.).

- Social Acceptance: The possibility of celebrating without alcohol, especially during events like Dry January, or for any convivial moment.

The heightened awareness of the negative effects associated with excessive alcohol consumption and the desire to maintain fitness have helped highlight functional beverages—those capable of providing minerals, vitamins, and other benefits (immunity, relaxation, energy).

1.2 Key Figures at a Glance

- The global non-alcoholic beverages market could reach 3.8 trillion dollars by 2034.

- In the United States, about 225.62 billion dollars is expected by 2030.

- Significant growth observed during and after the COVID-19 period, accelerating the demand for “mindful drinking” and alternative beverage options.

1.3 Technological Innovations

Dealcoholization processes are becoming more refined. Techniques like the GoLo Dealcoholization System, Alfa Laval’s all-in-one module, and AI solutions for optimizing flavor profiles help preserve taste, tannins, and a complex mouthfeel without the presence of alcohol. The challenge lies in achieving 0.05% or 0.0% alcohol content while maintaining sugar-acidity-bitterness balance.

The global non-alcoholic beverages market could reach 3.8 trillion dollars by 2034.

2. Essential Ingredients and Flavors

2.1 Superfoods and Adaptogens

Non-alcoholic beverages increasingly incorporate functional ingredients known for their supposed virtues:

- Superfoods

- Berries (blueberries, raspberries, strawberries): Rich in antioxidants, they add color and enhance flavor.

- Ginger : Spicy notes and anti-inflammatory benefits.

- Pomegranate : Bright red color, sweet-tangy flavor, reputed for its antioxidants.

- Hibiscus : Floral and tangy notes, contributing to intense coloration.

- Adaptogens

- Ashwagandha : Stress management, potential mood enhancement.

- Reishi : Associated with calm and relaxation.

- Maca : Energy boost, stress reduction.

- Lion's Mane : Possible support for cognitive function.

2.2 Botanicals and Nootropics

- Botanicals: Herbs (basil, rosemary, thyme), spices (cardamom, pepper, cinnamon), flowers (lavender, rose, chamomile). They add organoleptic complexity without weighing down the recipes.

- Nootropics: Substances promoted for concentration or relaxation (caffeine, GABA, 5-HTP). Brands sometimes combine cold-brewed coffee, plant extracts for relaxation, and adaptogens to create “functional drinks” with targeted effects (better mental clarity, calm, etc.).

2.3 Complexity of Flavors

Producers are striving to replicate the structure of an alcoholic beverage (body, astringency, lingering aftertaste) through:

- Tannins from tea, chocolate, or coffee.

- Spicy spices (chili, ginger) to recreate the burning notes associated with alcohol.

- Multiple infusions (maceration, steeping) for deep aromas.

Notable examples:

- Brands like Curious Elixirs or De Soi compete in blending fruits, spices, and adaptogenic plants to achieve complex cocktails.

- Mocktail Club adds prebiotics and fruit extracts for a flavor profile that is both tart and functional.

Non-alcoholic beverages are no longer confined to apéritif time or just ‘Dry January.’ We’re seeing them at different times of the day.” — Ludovic Mornand, Studio Blackthorns

3. Changes in Consumption

3.1 New Rituals

Non-alcoholic beverages are no longer limited to apéritif time or just “Dry January.” They can appear at different times of the day:

- Upon Waking: “Detox” or functional beverages (enriched waters, adaptogenic smoothies).

- Afternoon: Refreshments with moderate sugar content.

- Evening: High-end mocktails, alternative spirits (whiskey, gin, rum 0.0%), or 0.0% draft beer.

Key social events (weddings, corporate parties, Sunday family meals, nights out with friends) now include alcohol-free options. Consumers freely switch from “without” to “with” depending on the occasion, making the non-alcoholic beverage a natural choice in a single drinking session.

3.2 Personalization and Exploration

- Personalization: Custom labels (e.g., offering a personalized version of an alcohol-free sparkling), monthly subscription boxes, or DIY kits.

- Flavor Exploration: Variety packs (a selection of 3–4 flavors), original cocktails (inspired by world cuisines: chai, horchata, Korean sikhye, etc.).

3.3 Integration in HORECA and Companies

“No-alc” options are appearing in bars (dedicated mocktail sections) and even in the workplace (refrigerators stocked with natural energy drinks, alcohol-free coldbrew) to replace traditional coffee or highly sweetened sodas. In restaurants, there is growing attention to pairing dishes with non-alcoholic beverages, a segment poised to expand as more diners seek variety.

4. Focus on Packaging and Sustainability

4.1 Eco-Responsibility and On-the-Go Formats

Environmental requirements are gaining ground:

- Recycled Materials (PCR glass, recycled aluminum) and recyclable packaging.

- Reducing Plastic: Using cardboard, BIB (Bag-In-Box), or reusable containers to minimize carbon footprint.

- On-the-Go: 25 or 33 cl cans, flexible pouches, small easily portable formats. In certain regions, traditional beverages (e.g., kumis, ayran) are reimagined in ready-to-drink (RTD) format, often repackaged in a “modern” way.

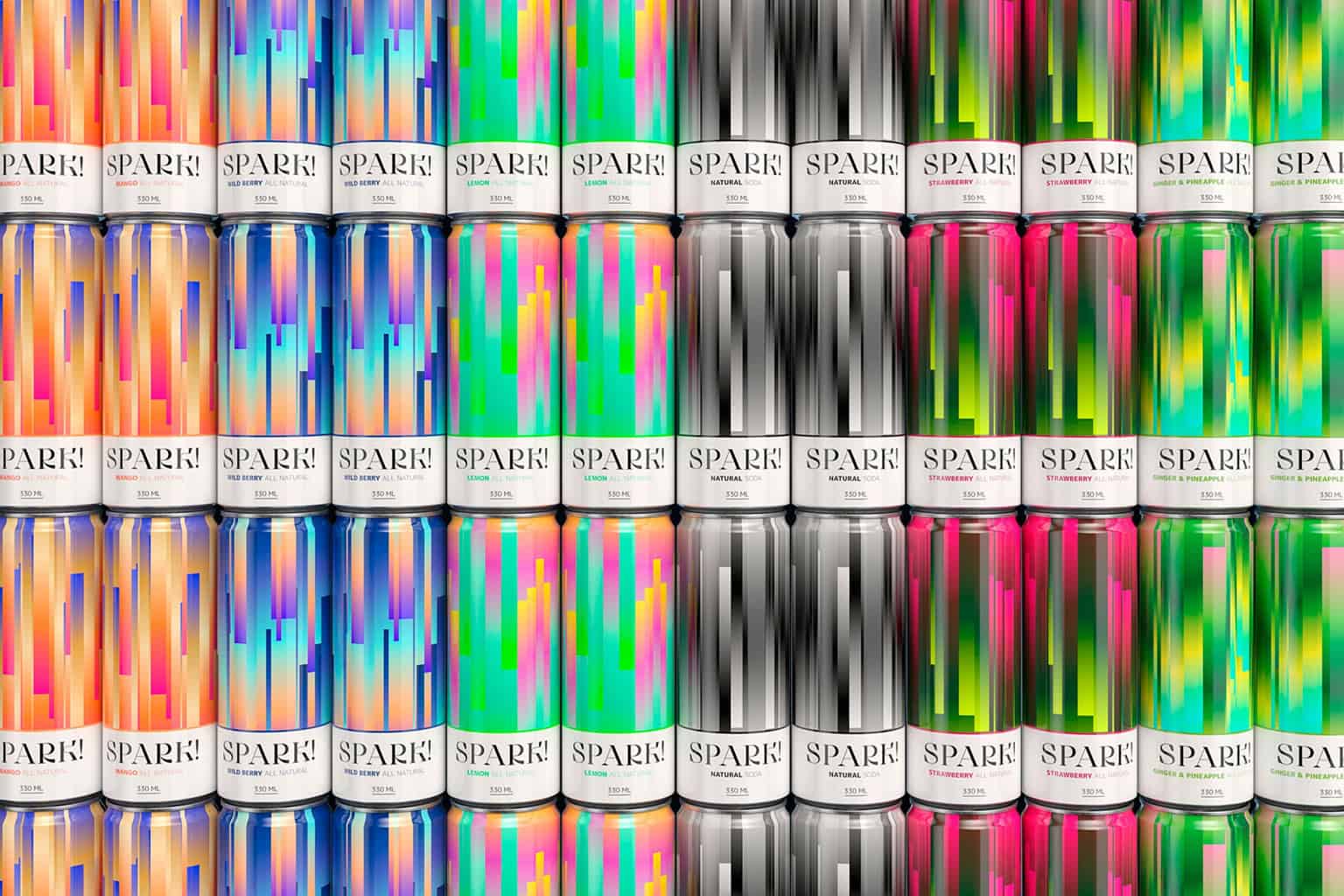

4.2 Eye-Catching Design for a Premium Image

- Minimalism: Restrained color palettes, clean graphics.

- Néo-Retro Trend: Handwritten fonts, vintage illustrations, a revival of flamboyant colors.

- Visual Storytelling: Flowers, mushrooms, zodiac symbols, or cultural elements (geographical origins) to highlight the botanical heritage or the “ritual” dimension of the product.

Some brands stand out through connected labels (QR codes, augmented reality), temperature-sensitive logos, or modular packaging (e.g., a lid that converts into a glass).

5. Emerging Technologies and Personalized Experiences

5.1 Artificial Intelligence in R&D and Marketing

- Product Development (AI): Analyzing and predicting tastes, virtually testing flavor combinations.

- Price Optimization & Marketing: Dynamically adjusting offers based on data (festive seasons, social media trends).

- Automation: Real-time monitoring of residual alcohol content, data logging to fine-tune each batch’s quality.

- Packaging Design: Various generative AI models for creating label visuals or text (product naming, descriptions, slogans…)

5.2 Augmented Reality (AR) and Interactions

- Animated Labels: Serving tutorials or mocktail recipes.

- Gaming Experiences: Some brands launch interactive games around their beverage to engage consumers.

- Impossible Bar: Example of the concept developed by Lyre’s to introduce the public to the “alcohol-free bar” through AR content.

Read also: Packaging Trends 2024/2025 on the Studio Blackthorns website.

Key Brands to Watch

The market for non-alcoholic beverages is seeing the emergence of brands that push the boundaries in terms of flavor, functionality and consumer experience. Here are a few brands/companies/groups to keep an eye on:

● Curious Elixirs : This brand offers alcohol-free cocktails infused with adaptogens and sophisticated flavor profiles. Founded in 2016, Curious Elixirs raised $36,000 via a Kickstarter crowdfunding campaign.

● Proposal : Produces ready-to-drink, alcohol-free beverages infused with adaptogens and unique flavor combinations. Founded in 2019, Proposition received undisclosed funding from Big Rock.

● Little Saints : Creates magical plant-based mocktails and spirits without sugar, using natural ingredients. Their line includes Paloma, Negroni Spritz, Mimosa, Ginger Mule, and Spicy Margarita mocktails, as well as St. Ember, an alcohol-free mezcal alternative.

● Aplós : Offers functional alcohol-free spirits infused with hemp and adaptogens. Their products include Aplós Calme, infused with hemp, and Aplós Arise, infused with adaptogens.

● Mocktail Club : Makes healthier alcohol-free beverages containing prebiotics and antioxidants. They source fruit juices from organic suppliers, use sustainable packaging, and donate 1% of their sales to support access to clean water globally. Flavors include Manhattan Berry, Havana Twist, Capri Sour, and Bombay Fire.

● ISH Spirits : Produces a range of alcohol-free alternatives to popular spirits and wines, including alcohol-free gin, rum, and sparkling wine.

● Bemuse : Specializes in modern non-alcoholic meads with complex flavor profiles, offering a contemporary interpretation of the ancient art of mead-making.

● Diageo : This global drinks giant has expanded its non-alcoholic offering with Guinness 0.0, Gordon’s Gin 0.0, and Captain Morgan’s 0.0. They also acquired Ritual Zero Proof, a leading brand of alcohol-free spirits.

● Pernod Ricard : This major beverage player has invested in the non-alcoholic sector through its venture capital fund.

● Carlsberg : This worldwide brewer offers alcohol-free versions of its popular beers, meeting the growing demand for alcohol-free options.

● Heineken : A pioneer in the beer market with its Heineken 0.0 range of non-alcoholic beers.

● PepsiCo : This global food and beverage company is a key player in the non-alcoholic beverage market, with brands like Pepsi, 7 Up, and Tropicana.

● The Coca-Cola Company : Another major player in non-alcoholic beverages with brands such as Coca-Cola, Sprite, and Fanta.

● Danone S.A. : This French multinational food company is a significant presence in the non-alcoholic beverage market, with brands like Evian and Volvic.

● Nestlé S.A. : This Swiss multinational food and drink processing conglomerate is a key player, with brands such as Nescafé and Nestea.

In the end

By 2025, the non-alcoholic beverage market offers exciting prospects:

- Market Expansion: From USD 1.1 trillion in 2018 to potentially USD 3.8 trillion by 2034.

- Emergence of Functional Ingredients (superfoods, adaptogens, nootropics) to meet health and wellness demands.

- Amplified Rituals: Mindful drinking, personalization, festive events where “0.0” genuinely holds a place.

- Key Role of Technology (AI, AR) in optimizing R&D, customer experience, and marketing.

- Rise of Specialized Brands: Premium cocktails, alternative spirits, and highly refined “beer 0.0.”

If you are a professional looking to develop your alcohol-free beverage, contact us: we can help you design a branding strategy, formulation, and launch plan adapted to these new expectations. Also, feel free to share this article if you believe these trends can benefit your network!

Sources

- Non-alcoholic Drinks Market Share, Trends 2025 | Industry Report, accessed December 19, 2024, https://www.millioninsights.com/industry-reports/global-non-alcoholic-drinks-market

- Non-Alcoholic Beverage Market Projected to Double by 2034, Reaching a Value of USD 3.8 Trillion - GlobeNewswire, accessed December 19, 2024, https://www.globenewswire.com/news-release/2024/08/21/2933620/0/en/Non-Alcoholic-Beverage-Market-Projected-to-Double-by-2034-Reaching-a-Value-of-USD-3-8-Trillion.html

- U.S. Non-Alcoholic Beverages Market Size & Growth [2030] - Fortune Business Insights, accessed December 19, 2024, https://www.fortunebusinessinsights.com/u-s-non-alcoholic-beverages-market-107932

- Next wave of non-alcoholic beverages to feature mood-boosting ingredients, accessed December 19, 2024, https://www.foodbusinessnews.net/articles/25226-next-wave-of-non-alcoholic-beverages-to-feature-mood-boosting-ingredients

- Your Guide to Making Superfood Mocktails - Nutrition Stripped, accessed December 19, 2024, https://nutritionstripped.com/your-guide-healthy-mocktails/

- Boost Your Mocktail to Superfood - Milwaukee North Shore Moms, accessed December 19, 2024, https://mkenorthshoremoms.com/boost-your-mocktail-to-superfood/

- 5 Trends to Watch 2024: Non-Alcoholic Beverage - Synergy Flavors, accessed December 19, 2024, https://www.synergytaste.com/insights/5-trends-to-watch-2024-non-alcoholic-beverage/

- Flavorman Predicts 2025 Beverage Industry Trends - Lane Report | Kentucky Business & Economic News, accessed December 19, 2024, https://www.lanereport.com/177653/2024/11/flavorman-predicts-2025-beverage-industry-trends/

- Exploring the Dynamics: Factors Contributing to the Rise of Non-Alcoholic Beverages, accessed December 19, 2024, https://thenonalcoholicclub.com/blogs/news/exploring-the-dynamics-factors-contributing-to-the-rise-of-non-alcoholic-beverages

- The Association of Influencer Marketing and Consumption of Non-Alcoholic Beer with the Purchase and Consumption of Alcohol by Adolescents - PMC, accessed December 19, 2024, https://pmc.ncbi.nlm.nih.gov/articles/PMC10215663/

- Beverage Packaging Innovation: 20 Examples from Around the ..., accessed December 19, 2024, https://triangleip.com/20-examples-of-beverage-packaging-innovation/

- Glass Packaging for Non-Alcoholic Drinks - Glass Bottle, accessed December 19, 2024, https://www.misapack.com/the-environmental-benefits-of-glass-packaging-for-non-alcoholic-drinks/

- Eco-Friendly Packaging Initiatives In The Beverage Industry - Future Drinks Expo, accessed December 19, 2024, https://futuredrinksexpo.com/en/blog/insights-64/eco-friendly-packaging-initiatives-in-the-beverage-industry-382.htm

- Non-alcoholic brewing - new technologies and big opportunities - Alfa Laval, accessed December 19, 2024, https://www.alfalaval.com/media/stories/beverage-processing/non-alcoholic-brewing-new-technologies-and-big-opportunities/

- Leading Non-Alcoholic Beverage Companies in AI - Just Drinks, accessed December 19, 2024, https://www.just-drinks.com/data-insights/top-ranked-non-alcoholic-beverages-companies-in-artificial-intelligence/

- BevZero Presents the Future of Non-Alcoholic Beverage Production ..., accessed December 19, 2024, https://wineindustryadvisor.com/2024/10/14/bevzero-presents-the-future-of-non-alcoholic-beverage-production/

(For more inspiring content, also check out our blog and our page dedicated to our brand identity projects.)

FAQ – Non-Alcoholic Beverages in 2025