Major Consumer Trends in Spirits 2025

The wine and spirits sector is buzzing in 2025. After a 2024 rich in innovations and bold launches, industry players are evolving to meet new consumer expectations. From creative ready-to-drink cocktails and sustainable, transparent spirits to the rise of immersive and personalised experiences, the consumption trends in the spirits sector for 2025 are shifting and redrawing the market landscape.

To help you gain clarity and anticipate the key challenges in the coming months, you can obtain the strategic report « Consumer Trends in Wines & Spirits – 2025 » published by Ludovic Mornand, founder of Studio Blackthorns.

Spirits Trends: Key Highlights from Q1 2024

The first quarter of 2024 was marked by an effervescence of product innovations, strategic moves, and fundamental evolutions in the world of spirits. From audacious product launches and acquisitions to major sustainability advancements, the sector has maintained a brisk pace despite ongoing uncertainties.

One standout feature was the surge of original and disruptive product launches. Among the most emblematic innovations are the futuristic whisky Horizon by Macallan x Bentley, the gin Grand Cabaret with stone fruit notes from Hendrick’s, and a surprising agave-peanut butter spirit from the brand Chica~Chida.

2023 was also defined by consolidation within distribution networks. Beam Suntory has launched its own structure in France, while Campari has acquired brands such as Bushmills—reshuffling the deck entirely.

A first quarter full of challenges and opportunities, heralding an audacious and creative 2024!

Alcohol & Gen Z: How to Adapt to New Trends?

Generation Z, born after 1995, represents a new challenge for alcohol brands. Being more frugal in their consumption, they require a fresh approach to remain both desirable and relevant.

First observation: Gen Z is less inclined to consume alcohol than previous generations. In countries such as Japan or the United States, a significant portion of 18–25-year-olds even report complete abstinence. This trend towards moderation and well-being is impacting volumes.

To attract this audience, brands are investing in product innovation with original, high-quality non-alcoholic alternatives. Hard seltzers, mocktails, 0.0% spirits… the range is expanding to meet these new expectations.

Another key is to rejuvenate one’s image by reinventing brand codes. Gone are the gendered, stereotypical representations – usher in an inclusive, unpretentious design. Packaging becomes a powerful means of expression and creativity to surprise on the shelves and spark conversations on social media.

But simply following trends is not enough to break through. Gen Z demands authenticity and consistency from brands. Beware of “young washing”! The challenge lies in striking the right balance between renewing a brand’s image and maintaining its core identity.

Major Cocktail Trends

In an era where consumers seek memorable experiences, the art of the cocktail is being completely reinvented to delight the palate and stimulate the senses. Here’s an overview of the most iconic trends at the moment.

The foremost driver of innovation is the pursuit of the extraordinary, with ultra-premium creations pushing the boundaries of mixology. Exceptional spirits, cutting-edge techniques, and unprecedented flavour combinations – no extravagance is too bold for a clientele in search of distinction.

Equally significant is the return to nature, with cocktails celebrating raw ingredients and authentic flavours: flowers, spices, herbs, and exotic citrus enrich the aromatic palette, offering an immersive tasting journey.

This natural orientation is paired with a demand for sustainability and transparency. Anti-waste initiatives, local supply chains, and the valorisation of by-products are compelling bartenders to create responsible and committed cocktails.

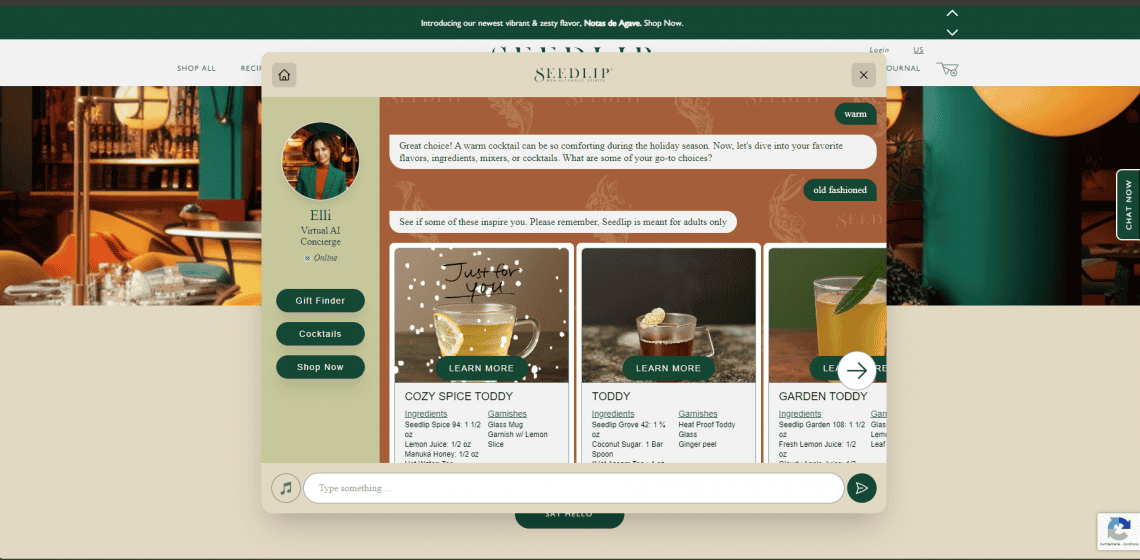

Innovation is also driven by personalisation, with cocktails becoming increasingly “tailor-made”. Thanks to AI, it is now possible to adapt a drink to each individual’s tastes and desires—a hyper-personalisation that promises to re-enchant the customer experience.

Yet, the timeless classics remain unchallenged: Mojito, Gin Tonic, Spritz… these iconic cocktails continue to lead the charts, buoyed by an enduring appeal for eternal recipes.

Non-Alcoholic: A Consumption Trend Becoming Habitual

One of the standout features of early 2024 is the undeniable establishment of the “No-Low” trend in purchase and drinking habits. Far from being a fleeting fad, the consumption of low or non-alcoholic beverages has become a lasting practice, in tune with consumers’ quest for naturalness and well-being.

As a sign of this democratisation, zero-alcohol products now consistently top the sales charts in mass distribution. Furthermore, the non-alcoholic spirits segment has surged by 7% in volume across the 10 main markets, with a marked preference for alternatives with a low alcohol content (<8%).

Both established players and new entrants are racing to expand their ranges to make them ever more qualitative and desirable. Seedlip, Lyre’s, and Ceders (Pernod-Ricard) are reinventing the sector with ultra-premium creations featuring complex flavours, while major brands have launched 0.0% versions – for example, the non-alcoholic gin from Beefeater, Gordon’s, or Tanqueray.

Ready-To-Drink Cocktails Steal the Show

As a spearhead of the sector, Ready-To-Drink (RTD) cocktails continue their meteoric rise, with an expected growth of 12% by 2027 across the 10 main markets – reaching a value of 40 billion dollars. This is achieved despite the waning of hard seltzers, which have been penalised by rising competition and a degree of consumer fatigue.

This dynamic is driven by the cocktail and long drink segment whose share is forecast to jump by 4 percentage points to 25% of RTD volumes by 2027. Their secret? An upgrade in recipes that are increasingly sophisticated and premium, crafted by major spirits brands. Think of the high-end creations by Bacardi, Campari, or the Absolut Vodka & Sprite partnership – capitalising on the trend of at-home aperitifs.

Another growth lever lies in original recipes boasting unprecedented flavours and textures designed to satisfy the experimental appetite of millennials. Kombucha, cold brew, CBD… combinations are multiplying to reinvent norms and captivate a young, urban audience. Likewise, healthy versions with reduced calories and sugars ride the wave of the health trend.

The challenge now is to capitalise on this success by innovating in packaging – creating an unforgettable experience from the moment of handling. Original cans, textured glass bottles, mini formats… creativity is essential to capture attention on the shelves and communicate a distinctive brand universe, perfectly suited for social media sharing.

The Era of Responsible Consumption in Spirits

Autres tendances de fond qui bouleversent le secteur : la quête de modération et de transparence, qui s’imposent comme les nouveaux piliers d’un rapport apaisé et mature à l’alcool.

This newfound awareness is driven by a convergence of factors: rising public health concerns, a distrust in institutions, and a rejection of the excesses of hyperconnection and overconsumption. These elements are prompting “consumer-actors” to adopt more frugal and measured behaviours.

In this context, the onus is on spirits brands to foster a qualitative and responsible approach centred on tasting and sharing. This strategic shift begins with an educational effort to accentuate the importance of terroir, know-how, and heritage.

Concretely, brands are investing in spiritourism and open-door events to let consumers in on the behind-the-scenes of their productions. Think of Hennessy’s exclusive cellar tours or Moon Harbour Distillery in Bordeaux offering tastings within its own facilities – a perfect way to re-enchant customer experience while affirming local roots.

Another significant aspect of this enlightened consumption is the premiumisation of the offer. With declining volumes, high-value products have become paramount. The success of the super and ultra-premium categories – driven by a growing demand for exceptional spirits – stands as the most tangible sign of this shift.

To meet this demand, players are deploying creative initiatives through limited editions, prestigious collaborations, or even exclusive cellar selections. For instance, Hennessy’s Editions Rares collection boasts confidentially boxed blends, while Glenfiddich’s Time Re:Imagined series reveals unprecedented aromatic profiles.

Sustainability also emerges as a major pillar in this quest for meaning and transparency. Lightweight packaging, the use of green energy, and regenerative agriculture programmes are being widely adopted to reduce the social and environmental impact of spirits.

Notably, 81% of consumers believe that social media has increased pressure on companies regarding CSR transparency, according to Diageo – a clear sign that sustainable performance is now a prerequisite for brands aspiring towards leadership.

Spirits in the Age of Tech

Finally, it is impossible to discuss the major shifts in the sector without addressing the technological revolution in customer experience. From AI to NFTs and virtual worlds, innovations are colliding to hybridise usage and reinvent the codes of tasting.

Digital marketing activations by Absolut in the metaverse or augmented reality tastings by Johnnie Walker stand testament to this trend: the boundary between the real and the virtual has never been so blurred, paving the way for increasingly immersive and personalised experiences.

This shift promises formidable growth opportunities for the most agile brands—provided they can strike the right balance between technological prowess and a soulful touch. The challenge lies in designing “useful” enhanced services that go beyond mere gimmicks, ensuring the consumer remains sustainably engaged.

For example, consider the prospects offered by generative AI – as Diageo is already using it to boost its packaging design – or the opportunities for gaming and co-creation through NFTs and metaverses, such as Heineken’s VR space or Hennessy’s NFT initiatives.

These initiatives are sketching out a new relational model that merges the phygital with the social, enabling ever more personal and engaging interactions with brand communities.

However, the sector must place ethics and responsibility at the heart of its digital transformation. Respect for privacy, digital sobriety, and accessibility are challenges that require utmost vigilance to ensure that technological progress goes hand in hand with social progress.

Would you like to delve deeper and access a comprehensive analysis of the trends that will shape the world of wines & spirits in 2024-2025?

Discover our complete report “Consumer Trends in Wines and Spirits – 2024/2025 Season (french version)”, a treasure trove of information and advice to help you stay ahead.

FAQ on Wines & Spirits Market Trends 2025