Spirits: key trends 2025-2026

The essentials in 30 seconds

Market context : Worldwide volumes of spirits fell by -1 % in 2024 (IWSR), with growth in value limited to +1 %. A sector undergoing profound transformation between economic pressures, changing lifestyles and the explosion of new categories.

The 6 major consumer trends 2025-2026 :

- RTD explosion - Ready-to-drink cocktails are expected to grow by +400 % in North America by 2029. Gen Z already represents 15 % of RTD consumers vs 12 % for wine (IWSR)

- Anchoring the No-Low - +9 % of alcohol-free volumes in 2024, 61 million new consumers in 2 years. Zebra striping« (alternating alcohol and non-alcoholic beverages) becomes more widespread.

- Aperitivo« opportunity» - Spritz dominates CHR sales in France (25 % of cocktail sales). US premium aperitifs: +18 % annual growth (2018-2023)

- Gen Z: new codes - Abandonment of traditional masculine imagery, rise of authentic «Creator Brands», aesthetics inspired by wellness and cannabis

- Selective premiuming - Drink less, but better«: consumers prioritize quality over quantity, guided by values rather than status

- Tech & counter-trend craftsmanship — AI for optimization (Diageo, Keychain) vs. anti-IA «handmade» movement celebrating imperfection and authenticity

New emerging categories :

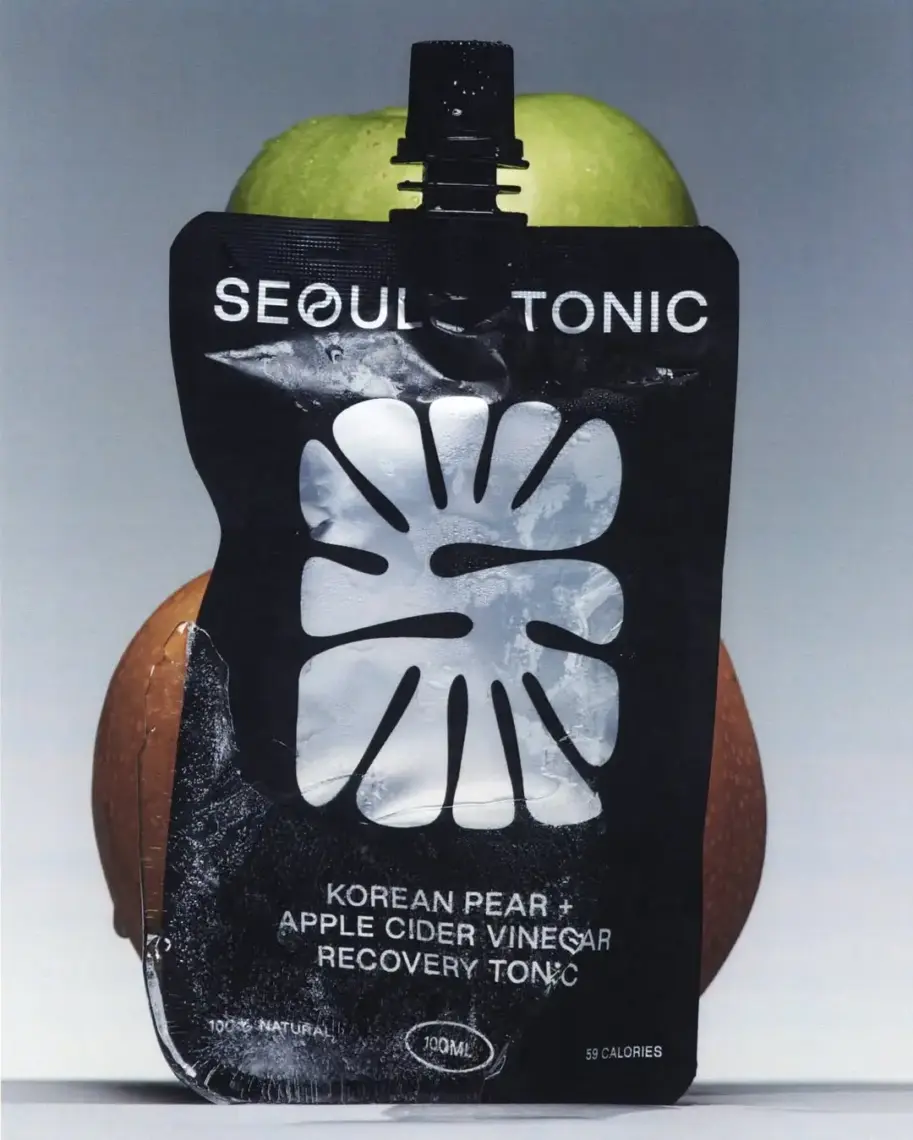

- Pre-alcohol« drinks» (ZBiotics, Seoul Tonic): preparing the body before consumption

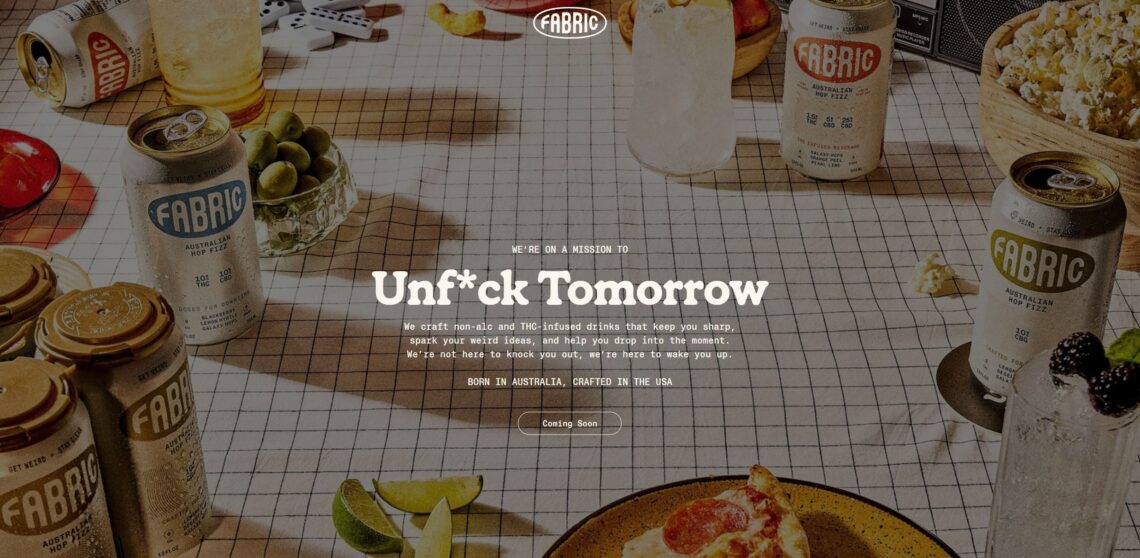

- THC beverages (Fabric, Cann): distinct US market

- Ultra-premium spirits Glenlivet 85 years, Glenfarclas 70 years, Appleton Estate 51 years

To remember: The sector is navigating between two contradictory forces - technological efficiency (AI, RTD, e-commerce) and the quest for authenticity (craftsmanship, transparency, real commitment from founders). The winning brands will be those that are able to reconcile these cultural tensions.

- The essentials in 30 seconds

- Introduction

- Spirits Trends for Fall 2025: Review of the First 8 Months

- Generation Z is Redefining Spirits Consumption Codes

- The Rise of Alternatives and New Beverage Categories

- Packaging Design: Mirror of Contemporary Cultural Tensions

- Technology Serving the Spirits Experience

- Responsible Consumption and Selective Premiumization in the Spirits Industry

- External and Geopolitical Challenges

- In the end

- Would you like to delve deeper and access a comprehensive analysis of the trends that will shape the world of wines & spirits in 2025?

Introduction

The global spirits market is undergoing a period of transformation in 2025. According to the latest IWSR data, total alcoholic beverage volumes declined by 1% in 2024, with value growth limited to 1%. In this challenging context, six major trends are reshaping the sector's future: from selective premiumization to geopolitical pressures, evolving lifestyles, and the rise of new categories. This article decodes the changes transforming spirits consumption in France and worldwide.

To help you create your spirits brand, anticipate the major issues of the moment or develop your spirits brand strategy, you can obtain the strategic report « Consumer Trends in Wines & Spirits – 2025 (French Ed) »published in April 2024 by Ludovic Mornand, founder of Studio Blackthorns.

Spirits Trends for Fall 2025: Review of the First 8 Months

The year 2025 has proven to be a period of profound contrasts for the spirits universe. Between persistent commercial tensions, major consolidations, and unbridled creativity, the market is navigating turbulent waters. As fall 2025 begins, it's time to distill the news and insights that have shaped the industry from January to August 2025.

1. Economic Context: Between Restructuring, Divestments, and Distilleries in Difficulty

The economic slowdown that began early in the year has been confirmed and has had tangible consequences.

- The tariff dance: The commercial wars saga has kept the industry on edge. Threats of American taxes on European products have caused "immense disappointment" from FEVS. Meanwhile, the conflict between China and Europe over brandies has continued despite signs of dialogue, continuing to heavily impact Cognac exports.

- Consolidation and strategic divestments: The market has seen significant movements. Campari Group divested its historic Cinzano brand, while William Grant & Sons finalized the acquisition of The Famous Grouse. In France, Dugas acquired La Fabrique de l'Arrangé, and Rémy Cointreau, through its RC Ventures fund, took a stake in the non-alcoholic brand JNPR Spirits.

- Distilleries under pressure: The most striking sign of the sector's difficulties has been several distilleries suspending production. After Brown-Forman and Campari early in the year, names like Roe & Co (Diageo), Dublin Liberties Distillery, and Tullamore D.E.W. have paused their production. Even more serious, Alsatian distillery Bertrand ceased operations, while Maison Lineti, Powerscourt, and Killarney in Ireland went through critical periods, seeking buyers to avoid liquidation.

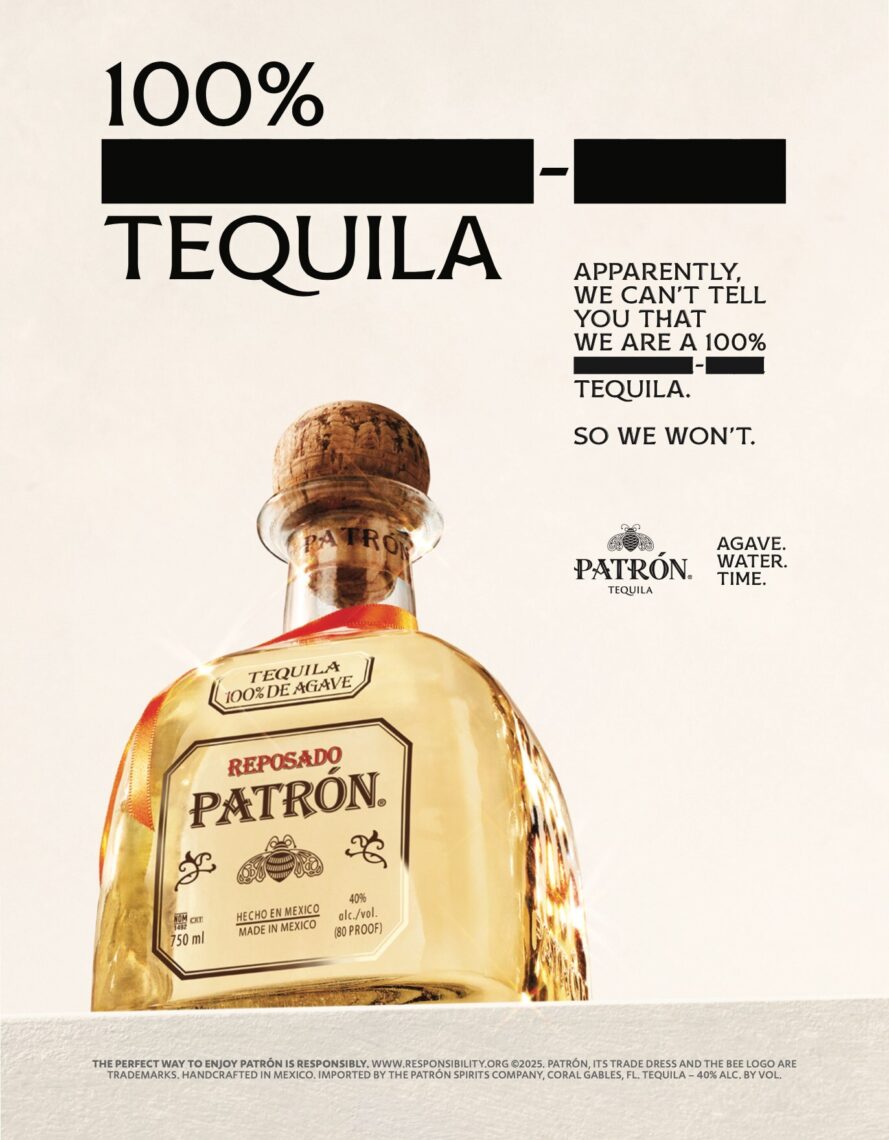

2. Regulation and Identity: Appellations at the Heart of the Issues

The definition and protection of spirits categories have been hot topics, illustrating the battle for identity and value.

- The European "Rye Whisky" controversy: A 2004 EU-Canada agreement resurfaced in a " ryediculous manner (as Frederic Roginska of Distilnewsput it), prohibiting European producers like Stauning from labeling their products as "Rye Whisky," causing widespread confusion and calls for renegotiation.

- The tequila transparency debate: The conflict between the Consejo Regulador del Tequila (CRT) and the Additive Free Alliance reached new heights. After a CRT complaint, Patrón (Bacardi) saw its exports temporarily suspended following its "additive-free" campaign, before launching a bold new campaign titled "Censored Truth" to denounce the lack of transparency in regulations.

- Geographic indications in motion: While American Single Malt was officially recognized early in the year, the French Whisky GI is advancing with stricter constraints than expected, particularly regarding barley origin and authorized barrel types. Meanwhile, the map of English whiskies continues to expand, now counting 61 distilleries.

3. Innovations and Launches: Audacity as a Response to Market Gloom

Faced with a complex market, brands have doubled down on creativity to stand out, pushing the boundaries of product and experience.

- The race for very old vintages: The quest for rare and ancient expressions has intensified. Gordon & MacPhail announced an 85-year-old Glenlivet, the oldest Scottish single malt ever bottled. It was closely followed by a 70-year-old Glenfarclas, a 65-year-old Glen Grant, and a 51-year-old Appleton Estate, presented as the oldest rum aged in tropical climate.

- Extreme maturation and unusual ingredients: Experimentation reigns supreme. Camus submerged a cognac barrel in the Atlantic, WhistlePig used coffin-shaped barrels for its whiskey, and Domhayn distillery plunged a barrel into the depths of Loch Ness. Ingredient-wise, we've seen the emergence of pizza-flavored vodka, asparagus gin, and even gin distilled with a chicken carcass, pechuga-style.

- Sustainability becomes tangible: Sustainable packaging is no longer just a concept. Pernod Ricard unveiled a paper cork for Absolut, while brands like Belle Gnôle adopted lightweight and reused glass bottles.

- Art and tech serving luxury: Collaboration between spirits and creative universes has produced gems, like the synthetic diamond created from 1800 tequila for the Met Gala, or the Johnnie Walker x Olivier Rousteing (Balmain) blends collection.

4. Consumption Trends: Gen Z, No-Low, and Spritz Leading the Charge

Purchasing and consumption habits have continued their slow but profound transformation.

- Gen Z, a nuanced generation: Several studies have refined the portrait of these young consumers. While a Rabobank study suggests they drink less due to economic factors and smartphone use, an IWSR report shows they're catching up to previous generations in alcohol consumption, questioning the idea of total disinterest.

- Cocktails reign supreme: Cocktails confirm their popularity. In the United States, they now outperform beer and wine in bar performance. In France, Spritz overwhelmingly dominates on-premise sales, representing nearly a quarter of cocktail revenue in May.

- Alcohol-free is no longer a niche: The No/Low market has attracted 61 million new consumers worldwide in two years according to IWSR. In France, the trend is palpable with the opening of numerous specialized shops and sharply rising sales figures.

- Safe bets resist: Despite trends, classics remain strong. In France, a liter of Ricard remains the best-selling product by value in retail for the year, demonstrating the power of heritage brands.

Generation Z is Redefining Spirits Consumption Codes

The Progressive Abandonment of Traditional Masculine Codes

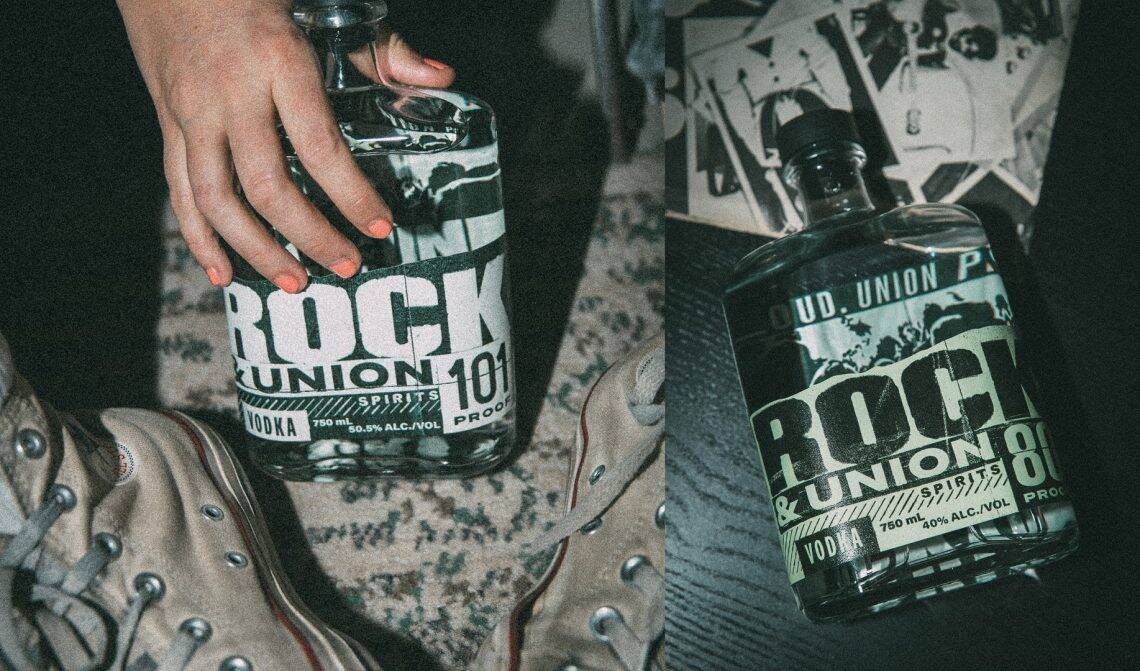

Visit Generation Z, representing 15% of RTD consumers compared to only 12% for traditional wine according to IWSR, is imposing new aesthetic standards on the spirits sector. Brands are progressively abandoning the traditional masculine imagery that has dominated the industry for decades. Gone are the heavy dark glass bottles, imposing serif typefaces, and austere color palettes that evoked power and exclusivity.

A new typographic wave is emerging, characterized by organic, fluid, and "dreamy" fonts. These designs draw inspiration from the wellness universe and tap into 1970s and 1990s nostalgia. This evolution transforms the spirits bottle into a decorative object destined to endure on shelves, well beyond product consumption.

According to Jesse Reed, founder ofOrder Type Foundry, this typographic direction constitutes "an intentional reaction against the austere and marked approaches that have defined spirits packaging for decades." This aesthetic also borrows from the visual codes of thecannabis industry, reflecting the evolution of consumer preferences who now favor cannabis over alcohol in their daily habits.

The Emergence of the "Trad Masc" Counter-Trend Movement

Paradoxically, a counter-trend is simultaneously emerging: the "Trad Masc" (Traditional Masculine) movement. This phenomenon sees certain brands reaffirming a traditional masculine aesthetic that is raw and unadorned. Products like Guinness beef jerky or plant-based jerky from the Agro brand illustrate this desire to reclaim a masculinity perceived as authentic.

This aesthetic duality reveals that there is no longer a single path to seducing Generation Z. Brands must navigate between different cultural identities, provided their proposition is supported by a coherent and authentic story. Success depends less on the style adopted than on the sincerity of the approach.

Authenticity as a New Selection Criterion

Beyond aesthetic considerations, Generation Z prioritizes authenticity in its consumption choices. "Creator Brands" or "Celebrity Brands," like Emma Chamberlain's Chamberlain Coffee or The Rock's Teremana Tequila, distinguish themselves from traditional celebrity brands through their founder's genuine involvement. This proximity generates trust capital that major brands struggle to match, even when adopting the visual codes of independent brands.

Authenticity is measured by the creator's visible engagement, their transmitted passion, and their direct connection with their community. Consumers quickly detect superficial marketing approaches and favor brands that demonstrate consistency between their stated values and concrete actions.

The Rise of Alternatives and New Beverage Categories

The RTD Phenomenon Disrupts the Traditional Landscape

One of the most striking developments of 2025 concerns the explosion of ready-to-drink (RTD) cocktails. According to IWSR, RTD cocktail and long drink volumes are expected to double globally between 2019 and 2029, with growth up to 400% in North America. This spectacular progression is redefining power dynamics in the industry.

Richard Halstead, COO Consumer Insights at IWSR, explains that "RTDs have become popular thanks to a combination of convenience, taste innovation, and messaging that aligns with health and moderation trends" These products also benefit from strong cultural support, often backed by celebrity influencers, and prove particularly suited to social media.

Competition with wine is intensifying: still wine's share in global services dropped from 11% in 2019 to 10% in 2024, and is expected to reach 9% in 2029. Meanwhile, RTDs grew from 1% to 2% market share over the same period.

"Pre-Alcohol" Beverages: A New Preventive Trend (or Not)?

The most disruptive innovation of 2025 concerns the emergence of "pre-alcohol" beverages. Brands like ZBiotics or Seoul Tonic offer functional formulas to consume before a night out to prepare the body and mitigate alcohol's negative effects. This preventive rather than curative approach resonates perfectly with a health-conscious generation.

Zack Abbott, CEO of ZBiotics, explains: "Biologically, the problem starts while you're drinking, not the next morning. When you drink, alcohol breaks down into a toxic molecule called acetaldehyde, which causes many next-day effects." This innovation marks the shift from a "detox" culture to a "preparation" culture.

These products symbolize a new approach to alcohol consumption, based on intention and responsibility. They allow consumers to maintain their social habits while preserving their wellness routines, thus creating a new consumption ritual. However, attention should be paid to their composition as European legislation is likely more stringent regarding such "health" products.

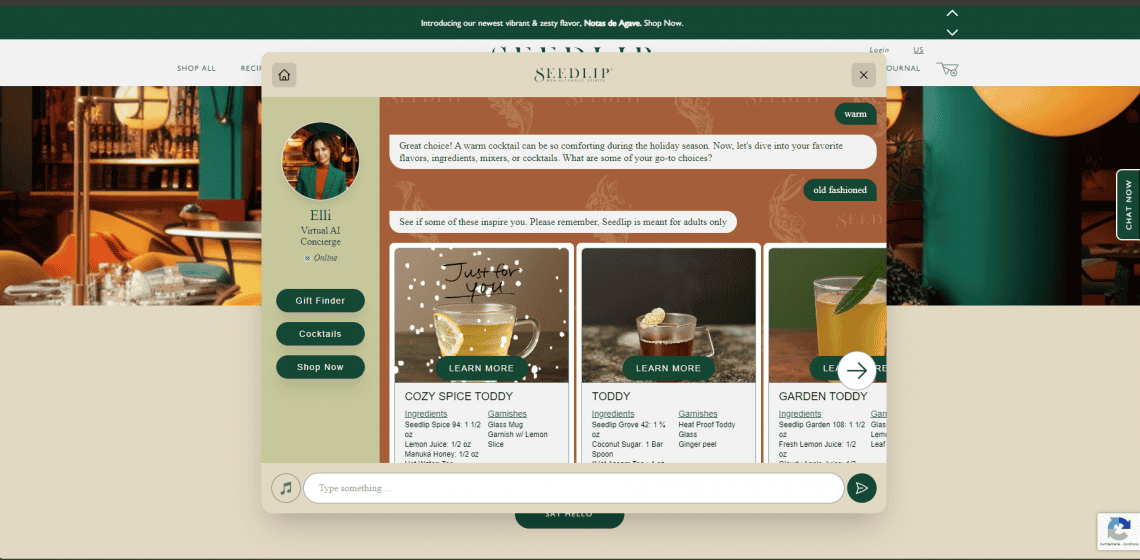

The No-Low Segment Confirms Its Lasting Foundation

The no- and low-alcohol beverage (No-Low) market is experiencing exceptional growth. IWSR reports a 9% increase in non-alcoholic beverage volumes in 2024, with significant cross-category gains. Beer remains dominant but other categories are gaining ground.

The " zebra striping " phenomenon—alternating between alcoholic and non-alcoholic beverages—is gaining popularity. This practice reflects a more conscious approach to consumption, where consumers maintain social pleasure while controlling their alcohol intake.

Both established players and new entrants are multiplying initiatives to enrich their offerings. Seedlip, Lyre's, or Ceders (Pernod Ricard) are reinventing the genre's codes with ultra-premium creations featuring complex flavors. Meanwhile, giants are adapting their bestsellers to 0.0% versions, like non-alcoholic gins from Beefeater, Gordon's, and Tanqueray, or more surprising associations like Suze Tonic 0.0%.

The "Aperitivo" Occasion Transforms Spirits Consumption

IWSR identifies the "aperitivo" occasion as a major growth driver for 2025. This trend toward early evening consumption, characterized by its relaxed and spontaneous aspect, particularly benefits spirit aperitifs, Prosecco, and premium light aperitifs.

Emily Neill, COO Research at IWSR, points out: «While many drinkers are moving away from the after-dinner moment, indicated by falling sales of fortified wines and Cognac, the results suggest that the aperitif remains in vogue». The spritz, the emblematic drink of this moment, has really taken off.

In the United States, premium spirit aperitifs exploded with 18% compound annual growth between 2018 and 2023, a trend expected to accelerate with a 19% forecast for 2023-2028. Italian Prosecco also rode this wave, with 5% annual growth between 2018 and 2023.

THC Beverages Create Their Own Market in the US

THC-infused beverages, illustrated by brands like Fabric, are breaking free from their status as alcohol alternatives to create their own category. Unlike early players like Cann who explicitly positioned themselves as alcohol substitutes, these new brands are developing their own consumption occasions.

Haylee Jordan, co-founder of Fabric, emphasizes: "We're not anti-alcohol; we're pro-choice. We believe THC beverages simply give people more ways to be intentional." This philosophy illustrates a major evolution: creating a distinct market rather than directly competing with alcohol.

With premium packaging, precise dosing, and promises linked to specific moments (concentration, socialization, relaxation), these beverages target a (US) clientele seeking controlled and personalized experiences.

Packaging Design: Mirror of Contemporary Cultural Tensions

The Overlooked Influence of Retail Buyers

A factor often overlooked yet considerably shapes packaging design : the influence of retail buyers. These professionals, true gatekeepers of market access, impose functional constraints that can trigger complete redesigns. complete overhauls.

Lauren Bijur, owner of Marché Local Grocery Consulting, emphasizes the unavoidable requirements: "The packaging must be operational, with a functional barcode, be easily displayable on shelves, and comply with FDA guidelines." These technical constraints directly influence aesthetic choices and can take precedence over purely creative considerations.

This reality explains why some redesigns seem disconnected from visual trends, prioritizing retail functionality over aesthetic innovation. Successful brands integrate these constraints from the design phase rather than suffering them after the fact.

Between Exit Strategies and Artisanal Authenticity

Careful market observation reveals the emergence of an "exit strategy aesthetic" among many startups. These brands present from launch such polished design, such modular brand systems , and such calibrated stories that they seem designed to be acquired by large groups.

This approach explains a certain homogenization of "premium-born" designs and contrasts with the authenticity sought by consumers. In reaction, an "anti-AI" movement values handmade work and imperfection. Brands like Brightland offer customizable bottles, transforming the consumer into an artist and celebrating the object's uniqueness.

This tension between commercial efficiency and creative authenticity defines an important part of the contemporary aesthetic landscape of spirits.

Gothic Aesthetics: Reflection of an Anxious Era

An unexpected aesthetic trend is emerging in spirits packaging: gothic influence. Beyond simple use of black, this approach seeks depth, texture, and complex narration. Brands like Evil Spirits Distillery or Chamucos Tequila use dark visuals, ancient typefaces, and mysterious narratives to offer a more introspective experience.

This evolution reflects ambient cultural anxiety and a thirst for more nuanced narratives in the face of contemporary uncertainty. As Jolene Delisle of The Working Assembly explains: "People are drawn to rituals, symbols, and the meaning they offer. Gothic aesthetics can seem familiar and inviting rather than niche."

This trend is rooted in the same psychological mechanisms that gave birth to medieval gothic art: expressing beauty in a context of uncertainty and existential fragility.

Technology Serving the Spirits Experience

Artificial Intelligence: Optimization and Prediction Tool for the Spirits Industry

Omnipresent in all business sectors, AI is no exception in the Wine and Spirits industry, from creation to distribution. Platforms like Keychain use artificial intelligence to optimize the search for manufacturing partners and analyze market trends. Diageo already deploys AI at scale to accelerate packaging creation and ensure global brand consistency.

IWSR highlights the growing importance of e-commerce, with 2% global value growth in 2024, driven by solid performance in spirits, beer, and RTDs. Asia-Pacific stands out with 4% growth, becoming a major driver of future growth.

AI excels in predictive trend analysis, processing data volumes impossible to manage humanly. It allows identification of weak signals before they become mass movements, giving brands valuable competitive advantage.

The "Handmade" Counter-Revolution Against AI

In direct response to the proliferation of AI, there is a growing movement to value the handmade. This trend celebrates the imperfection and authenticity of the human gesture, everything that AI cannot, by definition, reproduce. The « bedazzled" phenomenon, where influencers personalize products with manually applied rhinestones, illustrates this quest for uniqueness.

April Smith from BedazzleMe Studio explains: "Bedazzled products are eye-catching and creative, bringing a unique perspective to popular items. It goes beyond holding a product in front of a camera and gives the brand a personality that resonates with the audience."

This valorization of craftsmanship represents more than a trend: it expresses cultural resistance to technological homogenization and a search for authenticity in an increasingly digitized world.

Toward Immersive Phygital Experiences

The future of spirits experience is taking shape at the intersection of physical and digital.Absolut's activations tastings with augmented reality with Johnnie Walker's foreshadow a new relational model between brands and consumers.

These technological innovations may seem like "gimmicks," but they also respond to a real need for personalization and immersion. The challenge consists of creating authentic added value rather than technical prowess disconnected from consumer expectations.

Generative AI, NFTs, and virtual environments are redefining notions of ownership, exclusivity, and value creation, opening unprecedented perspectives for customer engagement.

Responsible Consumption and Selective Premiumization in the Spirits Industry

Premiumization Becomes Selective Facing Economic Pressures

IWSR identifies the evolution of premiumization as one of the major trends of 2025. This dynamic, previously linear, is now fragmenting under the effect of economic pressures and evolving consumer values. Premium and above volumes (excluding national spirits) grew by 3% in 2024, primarily driven by beer.

Emily Neill, COO Research at IWSR, explains: "Premiumization is becoming increasingly fragmented. Brand owners must invest in consumer sentiment monitoring and data to identify emerging growth areas." This selective premiumization is particularly manifested in cocktail culture, fueled by growing demand for unique experiences.

Health concerns and economic considerations are pushing consumers to drink less but choose better quality options. Rather than being motivated by status, they now prioritize purchases that reflect their personal values, occasion relevance, and perceived value.

Transparency as a New Standard

The demand for transparency is transforming consumer requirements. 81% of consumers consider that social media has increased pressure on companies regarding CSR transparency, according to Diageo. This evolution pushes brands to rethink their communication and practices.

Cultural identity and value consciousness also influence preferences for local brands in certain markets, notably in India where national pride and favorable quality-price perceptions have allowed Indian single malts to surpass their Scottish counterparts.

Transparency is no longer limited to ingredients but extends to production methods, working conditions, and environmental impact. Successful brands integrate this requirement from product design and make it a competitive advantage.

Sustainability and CSR Initiatives

Despite economic pressures, sustainable products continue to offer tangible opportunities. Consumers, particularly Generations Z and Y, still perceive sustainability as a quality indicator and are willing to pay for this added value.

Innovation focuses on concrete solutions: Neo Tea develops compostable tea bags, while Milkadamia revolutionizes oat milk packaging with flat sheets drastically reducing transport emissions.

These advances testify to an industry progressively integrating environmental challenges into its economic model, moving beyond statements of intent to adopt transformative practices.

External and Geopolitical Challenges

The Impact of Geopolitical Tensions on the Sector

There is a growing influence of external pressures on the spirits industry. After a turbulent 2024, marked by persistent conflicts and new geopolitical tensions, consumer behavior continues to be shaped by instability, trade disruptions, and economic challenges.

The impact of tariffs and new trade agreements varies by market and category. While Scottish whisky producers will benefit from the new free trade agreement signed between the UK and India, they face higher trade barriers when exporting to the United States.

Meanwhile, governments are strengthening their regulations and public health messages are hardening, impacting consumption, particularly in regions where trust in official advice is high, such as China, India, Latin America, and South Africa.

Evolving Lifestyles Facing Uncertainty

Persistent instability pushes consumers to reevaluate their priorities, seeking value for money, personalization, and immersive engagement. Many are turning away from traditional consumption occasions, favoring home and virtual experiences rather than traditional socialization.

Tourism is experiencing a recovery with a 3% increase in duty-free volumes in 2024, although spending remains cautious and value-focused. Consumers continue to prioritize unique travel experiences, forcing brands to adapt their approach.

Faced with persistent uncertainty, brand owners should therefore adopt contingency strategies, revise their supply chains, and explore emerging markets for growth opportunities.

In the end

Spirits trends at the end of 2025 reveal a sector in profound transformation, navigating a complex environment marked by declining volumes (-1%) and fragmented consumption habits. The emergence of selective premiumization, the explosion of RTDs (+400% projected in North America), and the rise of non-alcoholic beverages (+9% in 2024) are fundamentally reshaping the competitive landscape.

Generation Z is imposing new aesthetic and consumption codes, prioritizing authenticity over tradition and intention over impulse. The "aperitivo" occasion confirms itself as a major growth driver, while new beverage categories (non-alcoholic, pre-alcohol, CBD/THC, functional...) create their own markets.

Packaging becomes the mirror of broader cultural tensions, oscillating between the quest for meaning and commercial efficiency. This evolution requires brands to have a fine understanding of cultural currents to offer authentic and differentiating experiences in a context of growing geopolitical and economic pressures.

The future belongs to brands capable of synthesizing these contradictory influences into coherent propositions, combining innovation and tradition, technology and humanity, economic performance and social responsibility, while navigating with agility in an uncertain environment.

Would you like to delve deeper and access a comprehensive analysis of the trends that will shape the world of wines & spirits in 2025?

Discover our complete report “Consumer Trends in Wines and Spirits – 2024/2025 Season (french version)”, a treasure trove of information and advice to help you stay ahead.

FAQ on Wines & Spirits Market Trends 2025-2026